Stress at Work? Effective Strategies for Dealing with Professional Challenges

17 April 2024

What relief can you count on when establishing a sole proprietorship?

May 13, 2024Running a Limited Liability Company – a list of key things to remember

For many entrepreneurs, running a limited liability company (LLC) is a beneficial solution, but it can also be associated with certain difficulties.

It is therefore worth it for entrepreneurs to be aware of the important aspects of this process in order to avoid unpleasant surprises and run the company in accordance with current regulations. Here is a list of key issues to pay attention to:

Limited liability company

Legal personality of the company

A limited liability company acquires the status of a legal person upon registration in the appropriate register, i.e. the National Court Register (KRS). Before registration, when it operates as a limited liability company in organization, it can operate and pursue its goals, but does not have full legal capacity.

Choosing a company headquarters and address

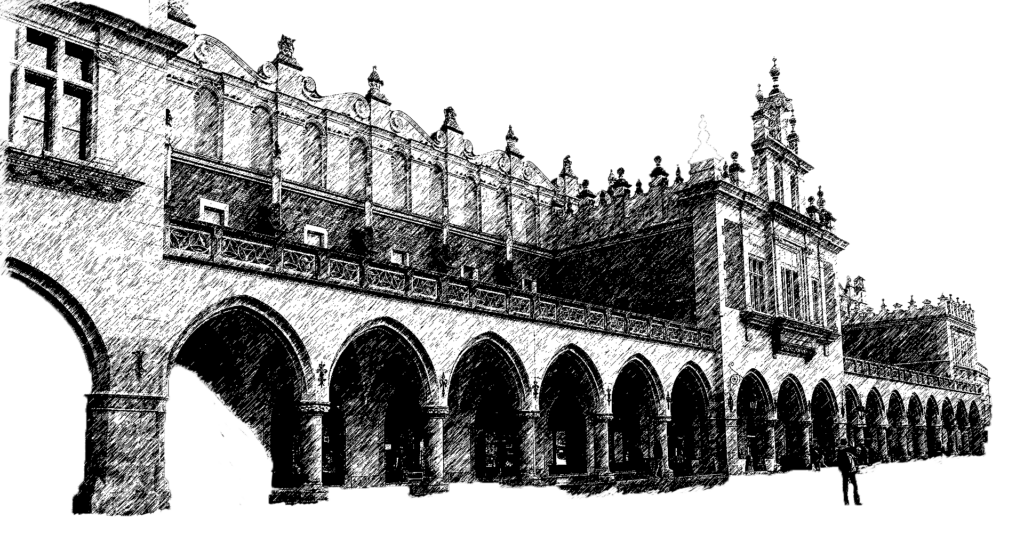

When choosing a company headquarters, it is worth considering that one of the best locations is Krakow. As for the place of registration itself, it is necessary to have the right to the premises where we register the company. This cannot be done, for example, in a rented apartment without the consent of the owner of the premises. If the future entrepreneur does not have his own premises, it is worth reviewing the offer virtual offices.

Election of members of the company's bodies

The General Meeting of Shareholders is most often a group of people who founded the company by contributing to it. It is the General Meeting of Shareholders that has the authority to elect the key bodies of the company, such as the management board and the supervisory board. In a situation where legal regulations do not impose an obligation to establish a supervisory board, the decision to establish it can be included in the company's articles of association.

Liability of members of the management board of a limited liability company

The liability of members of the company's management board is not subject to limitations, as in the case of partners, whose liability is usually limited to the amount of the share capital. A member of the management board is obliged to bear liability to the company for any damages resulting from his actions or omissions contrary to the law or the provisions of the company agreement, unless his innocence is proven.

Bookkeeping for a limited liability company

A limited liability company is obliged to conduct full accounting and there is no possibility of using simplified forms of settlement, such as flat-rate tax, tax card or revenue and expense ledger. Therefore, it is usually necessary to sign an agreement with accounting office in order to ensure proper bookkeeping. In addition, tax reporting VAT must be made before the first taxable transaction is made, in accordance with applicable regulations.

ZUS in a limited liability company

Partners in a limited liability company are not required to pay compulsory social insurance. However, this obligation applies to people employed by the company. However, there is an exception for a single-member limited liability company, where its sole partner or owner is required to pay ZUS contributions.

Taxes in a limited liability company

Once a limited liability company makes a profit, it must first pay corporate tax (CIT)

at 19 or 9 percent. After paying CIT,

the company may proceed to distribute profits to partners. Partners will be subject to personal income tax (PIT), which is collected by the company itself.

Finance and payments in a limited liability company. In business relations, it is possible to make payments in cash or cashless. However, there is a limit. In the case of transactions exceeding PLN 15 thousand gross, a cashless payment is required.

Limited liability company and hiring employees

When hiring an employee, the first step is to sign an employment contract with them. The next step is to refer the employee for tests to an occupational health physician and to conduct training in occupational health and safety (OSH). Additionally, the employer must register the employee with the Social Insurance Institution (ZUS).

Verification of contractors before payment

Before making a payment to the company, business is obliged to verify its status on the White List of VAT taxpayers and transfer the funds to the bank account indicated there.

Limited liability company

Remembering the essential elements of a limited liability company's operation can significantly facilitate the management of the company. It is also necessary to constantly adapt to changing regulations and legal standards. Being aware of and following these guidelines will ensure the smooth operation of the company and avoiding unwanted problems.

Thanks virtual office entrepreneurs can use services such as a registered address, correspondence service or professional telephone service, without having to rent a physical space. This is a flexible solution that saves time and money, and also ensures a professional image of the company. Virtual office is becoming increasingly popular in the digital age, allowing you to run a business from anywhere in the world.

1 Comment

[…] companies, but with the development of digital technologies and public registry systems, such as the National Court Register (KRS), their role has significantly diminished. Many countries have long since abandoned this requirement, which […]