Is there an ideal customer?

3 March 2025

Business plan vs reality

11 March 2025Entrepreneur vs. Tax Office – a survival guide in a world of incomprehensible regulations

Running a business in Poland it's like being on a reality show where no one knows the rules but everyone pretends to understand them. In this show, the biggest challenge is clash with the Tax Office – an institution that can ruin even the best day with a single letter. If you’ve ever wondered how to survive this adventure without heart palpitations and losing all trace of common sense, here are some proven strategies.

Don't panic… yet!

When a message from the Tax Office appears in your mailbox and the header says "control" - don't drop everything and book a one-way ticket to a desert island. It may be just a routine question or information about a new form that needs to be filled out... by yesterday. Breathe deeply and read the content before you panic. If it still sounds scary, go to point 2.

Consult an accountant (or exorcist)

In the world of entrepreneurs a good accountantis like a magician – he can demystify even the most complicated tax regulations. If you receive a letter that you do not understand, the first rule is: don't pretend to understand. Just pass it on accountant and wait for the verdict. If he says “calm down, this is standard procedure”, you can go back to drinking coffee. However, if he says “this will be interesting” – prepare the lemon balm and go to point 3.

Prepare your documents (and patience)

The tax office loves documents. And it loves asking for the ones you've already sent them even more. So have everything at hand: invoices, PITs, contracts, and Excel printouts, which you used to calculate the cost of printer paper in 2017. Sometimes it's also useful to know the regulations, but remember - they can change during the audit.

Adopt the philosophy of “The Office is Always Right” (for a while)

One of the basic rules of survival is to nod humbly and pretend that everything is under control. The inspector says you misreported the coffee expense? “Of course, I’ll fix it.” He says the invoice should be in a different format? “Yes, yes, I’m changing it now.” And then… check it with your accountant, because there is a 50% chance that in two months the regulations will change and you were right.

Never ask “but why?”

Officials don't like this question. The answer is usually: "because that's how it is" or "because those are the rules" (even if yesterday was different). At best, you'll get a 20-page tax ruling written in a language that makes medieval Latin manuscripts seem like light evening reading. So if you really need to clarify something, it's best to ask accountant. She knows the translation of "clerical" into Polish.

Remember – it can always be worse

If you think you're having a bad day, remember that there are entrepreneurs who had to explain to the tax office why they deducted VAT from a pizza ordered for a meeting with a client. Or those who spent three months explaining why their invoices had different numbering in March 2021 than in February. In this world of absurdity, no one is safe.

After all, reward yourself!

If you managed to survive the inspection without any major losses, congratulations are in order! And best of all – a solid reward: coffee, cake, and maybe even a free afternoon (yes, yes, entrepreneurs sometimes have free time… at least in theory). However, if the inspection ended with another pile of documents to fill out, well – welcome to the club, melissa is in the kitchen!

Summary: How to survive a clash with the Tax Office and stay healthy?

Let's not kid ourselves - nobody likes visits from officials, but you can approach it calmly (or with humor). The key rules are: don't panic, have a good accountant, don't ask difficult questions and always have a copy of everything.

And if anyone still thinks that running a business is all about freedom and success, let them try to survive their first tax audit. After this experience, nothing is scary anymore.

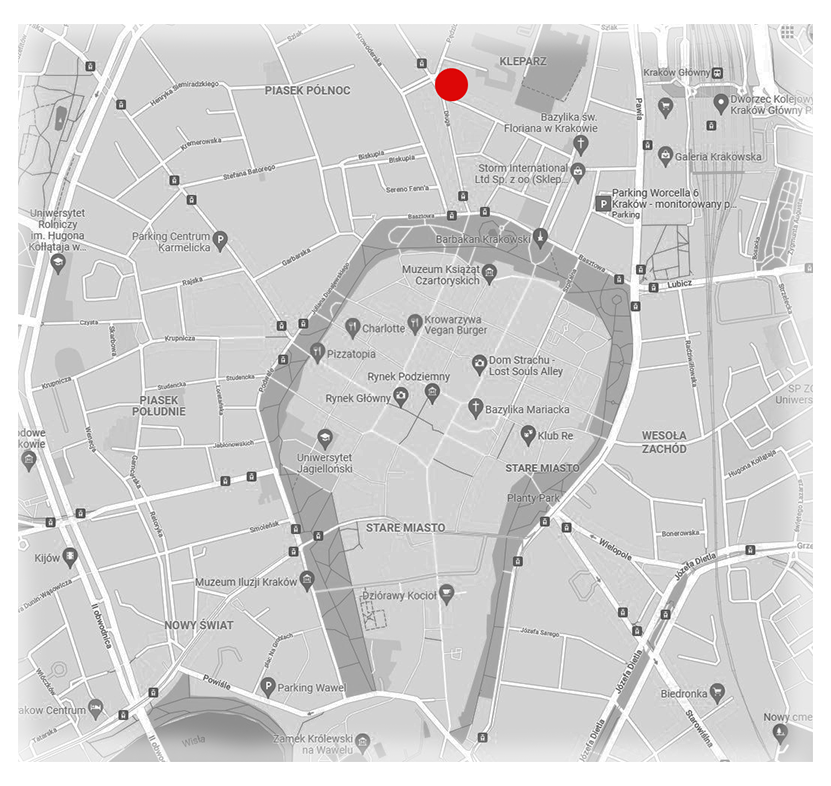

Register your company at a prestigious address in Krakow and gain a professional image without high costs. Our virtual office provides full correspondence handling and administrative support, so you can focus on developing your business. Take advantage of our Virtual Office in the center of Krakow.